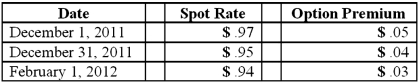

On December 1, 2011, Keenan Company, a U.S. firm, sold merchandise to Velez Company of Canada for 150,000 Canadian dollars (CAD) . Collection of the receivable is due on February 1, 2012. Keenan purchased a foreign currency put option with a strike price of $.97 (U.S.) on December 1, 2011. This foreign currency option is designated as a cash flow hedge. Relevant exchange rates follow:

Compute the fair value of the foreign currency option at December 31, 2011.

Definitions:

Q6: Cleary, Wasser, and Nolan formed a partnership

Q29: When a company applies the initial method

Q39: For each of the following situations, select

Q39: Panton, Inc. acquired 18,000 shares of Glotfelty

Q55: What would differ between a statement of

Q59: The balance sheet of Rogers, Dennis &

Q64: Pell Company acquires 80% of Demers Company

Q65: If your electronic communication device use is

Q110: How does the partial equity method differ

Q112: Kaye Company acquired 100% of Fiore Company