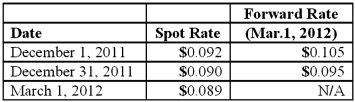

On December 1, 2011, Joseph Company, a U.S. company, entered into a three-month forward contract to purchase 50,000 pesos on March 1, 2012, as a fair value hedge of a foreign currency denominated account payable. The following U.S. dollar per peso exchange rates apply:

Joseph's incremental borrowing rate is 12 percent. The present value factor for two months at an annual interest rate of 12 percent is .9803. Which of the following is included in Joseph's December 31, 2011 balance sheet for the forward contract?

Definitions:

Due Diligence Reports

Comprehensive assessments conducted to evaluate the business’s legal, financial, and operational status before entering into an agreement or transaction.

Investment Proposals

Documents that outline detailed plans for spending capital with the intent of generating returns or profits.

Informational Reports

Reports aimed at providing facts and data without rendering opinions or recommendations.

Analytical Reports

Detailed documents that provide data analysis, explanations, and recommendations, aiming to support decision-making processes.

Q4: Which of the following type of organization

Q14: Which accounts are translated using current exchange

Q24: On January 1, 2011, Wakefield City purchased

Q30: Pell Company acquires 80% of Demers Company

Q40: Wilson owned equipment with an estimated life

Q42: These questions are based on the following

Q43: Wolff Corporation owns 70 percent of the

Q47: How does the existence of a non-controlling

Q50: Which of the following must be presented

Q77: Walsh Company sells inventory to its subsidiary,