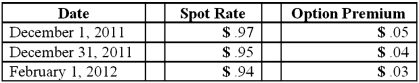

On December 1, 2011, Keenan Company, a U.S. firm, sold merchandise to Velez Company of Canada for 150,000 Canadian dollars (CAD) . Collection of the receivable is due on February 1, 2012. Keenan purchased a foreign currency put option with a strike price of $.97 (U.S.) on December 1, 2011. This foreign currency option is designated as a cash flow hedge. Relevant exchange rates follow:

Compute the fair value of the foreign currency option at February 1, 2012.

Definitions:

Abnormal Respiratory Values

Measurements that fall outside the normal range for breathing variables, indicating potential respiratory dysfunction.

Thyroid Cartilage

The largest cartilage in the larynx, commonly known as the Adam's apple, located at the front of the neck.

Respiratory Center

A group of neurons in the brainstem that regulate the rate and depth of breathing.

Depression

Movement of a structure in an inferior direction.

Q1: Norr and Caylor established a partnership on

Q1: The town council adopted an annual budget

Q13: As of January 1, 2011, the partnership

Q14: When leaving a voice mail message<br>A) Speak

Q21: All technology tools and information is company

Q25: A local partnership has assets of cash

Q35: Car Corp. (a U.S.-based company) sold parts

Q44: Coyote Corp. (a U.S. company in Texas)

Q71: On January 1, 2011, Musial Corp. sold

Q108: On January 1, 2010, Smeder Company, an