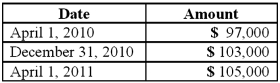

On April 1, 2010, Shannon Company, a U.S. company, borrowed 100,000 euros from a foreign bank by signing an interest-bearing note due April 1, 2011. The dollar value of the loan was as follows:

How much foreign exchange gain or loss should be included in Shannon's 2010 income statement?

Definitions:

Per-unit Tax

A tax imposed on each unit of a good or service sold, affecting the supply curve by increasing production costs.

Tax Burden

The total amount of tax levied on an individual, corporation, or other entity, often expressed as a proportion of income or economic output.

Buyers

Buyers are those who acquire products or services for personal use or for resale, generating demand in the market.

Per-unit Tax

A tax that is levied on each unit of a product or service sold.

Q3: Which one of the following is a

Q39: Panton, Inc. acquired 18,000 shares of Glotfelty

Q43: On January 1, 2011, Payton Co. sold

Q47: The Keaton, Lewis, and Meador partnership had

Q56: What is the purpose of fund financial

Q59: Norr and Caylor established a partnership on

Q70: The Town of Anthrop receives a $10,000

Q73: Where should a non-controlling interest appear on

Q81: On October 1, 2011, Jarvis Co. sold

Q100: Following are selected accounts for Green Corporation