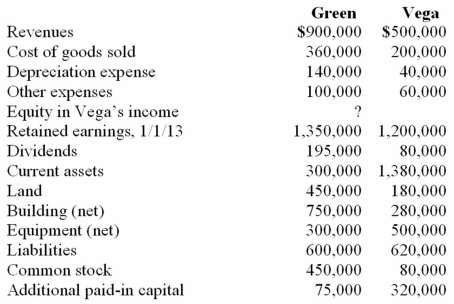

Following are selected accounts for Green Corporation and Vega Company as of December 31, 2013. Several of Green's accounts have been omitted.

Green acquired 100% of Vega on January 1, 2009, by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share. On January 1, 2009, Vega's land was undervalued by $40,000, its buildings were overvalued by $30,000, and equipment was undervalued by $80,000. The buildings have a 20-year life and the equipment has a 10-year life. $50,000 was attributed to an unrecorded trademark with a 16-year remaining life. There was no goodwill associated with this investment.

Compute the December 31, 2013, consolidated equipment.

Definitions:

Hostile Environment

An unwelcoming or unpleasant atmosphere, especially in the workplace, which may involve harassment or discrimination.

Hedonist

A person who believes that the pursuit of pleasure or happiness is the most important goal in life.

Might-Equals-Right

A belief or principle that power and strength justify moral superiority or rightful authority.

Self-Serving

Behaviors or attitudes that prioritize an individual's own interests, benefits, or welfare over those of others.

Q18: Where can you find exchange rates between

Q35: The Declaration of Principles Concerning Activities Following

Q36: Following are selected accounts for Green Corporation

Q53: On January 1, 2010, Mehan, Incorporated purchased

Q62: On January 1, 2011, Riney Co. owned

Q68: McGuire Company acquired 90 percent of Hogan

Q74: Dodge, Incorporated acquires 15% of Gates Corporation

Q78: Parent Corporation had just purchased some of

Q81: Watkins, Inc. acquires all of the outstanding

Q88: Flynn acquires 100 percent of the outstanding