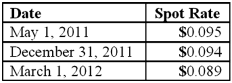

On May 1, 2011, Mosby Company received an order to sell a machine to a customer in Canada at a price of 2,000,000 Mexican pesos. The machine was shipped and payment was received on March 1, 2012. On May 1, 2011, Mosby purchased a put option giving it the right to sell 2,000,000 pesos on March 1, 2012 at a price of $190,000. Mosby properly designates the option as a fair value hedge of the peso firm commitment. The option cost $3,000 and had a fair value of $3,200 on December 31, 2011. The following spot exchange rates apply:

Mosby's incremental borrowing rate is 12 percent, and the present value factor for two months at a 12 percent annual rate is .9803.

What was the impact on Mosby's 2011 net income as a result of this fair value hedge of a firm commitment?

Definitions:

"On a Frolic of His Own"

This phrase describes a situation where an employee undertakes actions that are substantially different from their employment duties, thus removing employer liability for those actions.

Mediation

A discussion between the parties to a dispute that is facilitated by a mediator in an effort to encourage and assist them in coming to an agreement.

Employment Standards Act

Legislation that outlines the minimum standards employers must meet in terms of wages, working hours, leaves, and other employment conditions.

Trade Unions' Activities

Collective efforts and operations carried out by organized groups of workers to protect their rights and interests.

Q8: King Corp. owns 85% of James Co.

Q19: Pursley, Inc. owns 70 percent of Harry,

Q24: Red Co. acquired 100% of Green, Inc.

Q28: What accounting transactions are not recorded by

Q42: On August 21, 2011, Fred City transferred

Q46: McGuire Company acquired 90 percent of Hogan

Q69: P, L, and O are partners with

Q76: On November 10, 2011, King Co. sold

Q90: Companies may use social media tools such

Q111: When a company applies the initial value