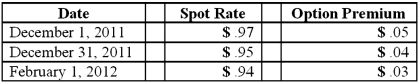

On December 1, 2011, Keenan Company, a U.S. firm, sold merchandise to Velez Company of Canada for 150,000 Canadian dollars (CAD) . Collection of the receivable is due on February 1, 2012. Keenan purchased a foreign currency put option with a strike price of $.97 (U.S.) on December 1, 2011. This foreign currency option is designated as a cash flow hedge. Relevant exchange rates follow:

Compute the U.S. dollars received on February 1, 2012.

Definitions:

Power

The ability or capacity to direct or influence the behavior of others or the course of events.

Requests for Proposals

Formal invitations issued by organizations seeking bids or proposals for services, projects, or products from suppliers or contractors.

Grant Opportunities

Opportunities for obtaining financial support, typically for specific projects or programs, provided by governments, foundations, or other entities.

Government Agencies

Public sector bodies, either federal, state, or local, that administer and enforce laws, policies, and regulations.

Q16: Patti Company owns 80% of the common

Q25: When taking a phone call without explanation

Q29: On March 1, 2011, Mattie Company received

Q31: A business e-mail:<br>A) Is a necessary workplace

Q45: One company acquires another company in a

Q63: What is the major assumption underlying the

Q63: Shell City transfers $100,000 from the General

Q65: Goehler, Inc. acquires all of the voting

Q88: On January 1, 2011, Musial Corp. sold

Q88: When leaving a voice mail message<br>A) State