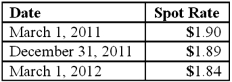

On March 1, 2011, Mattie Company received an order to sell a machine to a customer in England at a price of 200,000 British pounds. The machine was shipped and payment was received on March 1, 2012. On March 1, 2011, Mattie purchased a put option giving it the right to sell 200,000 British pounds on March 1, 2012 at a price of $380,000. Mattie properly designates the option as a fair hedge of the pound firm commitment. The option cost $2,000 and had a fair value of $2,200 on December 31, 2011. The following spot exchange rates apply:

Mattie's incremental borrowing rate is 12 percent, and the present value factor for two months at a 12 percent annual rate is .9803.

What was the net impact on Mattie's 2012 income as a result of this fair value hedge of a firm commitment?

Definitions:

Returns to Scale

The change in output resulting from a proportionate increase in all inputs (factors of production), where increasing, constant, and decreasing returns to scale can occur.

Long-Run Average Total Cost

The average cost per unit of output in the long term when all inputs can be varied by the firm and economies of scale have been reached.

Output

The total amount of goods or services produced by a company, industry, or economy within a given period.

Returns to Scale

The rate at which output increases in response to a proportional increase in all inputs (factors of production).

Q14: A U.S. company sells merchandise to a

Q19: The partners of Apple, Bere, and Carroll

Q33: Which of the following could result in

Q36: A foreign subsidiary uses the first-in first-out

Q39: For each of the following situations, select

Q45: A new truck was ordered for the

Q55: Pell Company acquires 80% of Demers Company

Q55: What are the broad types or classifications

Q90: A historical exchange rate for common stock

Q105: Which of the following is not an