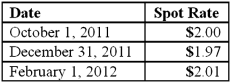

On October 1, 2011, Eagle Company forecasts the purchase of inventory from a British supplier on February 1, 2012, at a price of 100,000 British pounds. On October 1, 2011, Eagle pays $1,800 for a three-month call option on 100,000 pounds with a strike price of $2.00 per pound. The option is considered to be a cash flow hedge of a forecasted foreign currency transaction. On December 31, 2011, the option has a fair value of $1,600. The following spot exchange rates apply:

What is the amount of option expense for 2012 from these transactions?

Definitions:

Liquidity Premium

Additional yield that investors demand for holding a security that is not easily traded or sold without a significant price reduction.

Maturity Risk Premium

The extra yield that investors demand to compensate for the risk of holding a bond until its maturity date.

T-bonds

Treasury bonds, long-term government debt securities with maturity periods typically over 20 years, offering interest payments semiannually.

Corporate Bonds

Debt securities issued by corporations to finance their operations, expansions, or projects, which pay fixed or variable interest rates to investors.

Q5: The Town of Portsmouth has at the

Q26: Under what circumstances does a partner's balance

Q36: Cleary, Wasser, and Nolan formed a partnership

Q53: Rojas Co. owned 7,000 shares (70%) of

Q55: Pell Company acquires 80% of Demers Company

Q56: Ryan Company owns 80% of Chase Company.

Q61: Jones, Marge, and Tate LLP decided to

Q85: When is a goodwill impairment loss recognized?<br>A)

Q88: According to U.S. GAAP for a local

Q119: Several years ago Polar Inc. acquired an