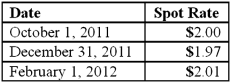

On October 1, 2011, Eagle Company forecasts the purchase of inventory from a British supplier on February 1, 2012, at a price of 100,000 British pounds. On October 1, 2011, Eagle pays $1,800 for a three-month call option on 100,000 pounds with a strike price of $2.00 per pound. The option is considered to be a cash flow hedge of a forecasted foreign currency transaction. On December 31, 2011, the option has a fair value of $1,600. The following spot exchange rates apply:

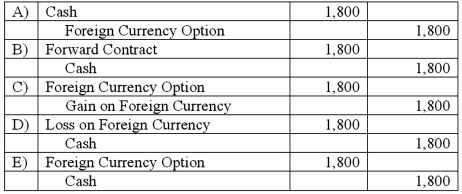

What journal entry should Eagle prepare on October 1, 2011?

Definitions:

Facets

Different aspects or sides of an object, concept, or phenomenon.

Command

An authoritative order or directive given by a person in power.

Solo Effect

The solo effect occurs when an individual working alone on a task performs differently, typically better, than when working in a group.

Minority Groups

Demographic groups that are smaller in number within a larger society or community, often distinguished by cultural, ethnic, or racial differences.

Q8: Atherton, Inc., a U.S. company, expects to

Q36: A foreign subsidiary uses the first-in first-out

Q38: On March 1, 2011, Mattie Company received

Q41: Under the equity method of accounting for

Q51: White, Sands, and Luke has the following

Q54: Knight Co. owned 80% of the common

Q62: Cleary, Wasser, and Nolan formed a partnership

Q93: Kennedy Company acquired all of the outstanding

Q113: Which of the following will result in

Q116: Under the initial value method, when accounting