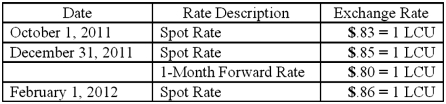

On October 1, 2011, Jarvis Co. sold inventory to a customer in a foreign country, denominated in 100,000 local currency units (LCU). Collection is expected in four months. On October 1, 2011, a forward exchange contract was acquired whereby Jarvis Co. was to pay 100,000 LCU in four months (on February 1, 2012) and receive $78,000 in U.S. dollars. The spot and forward rates for the LCU were as follows:

The company's borrowing rate is 12%. The present value factor for one month is .9901.

Any discount or premium on the contract is amortized using the straight-line method.

Assuming this is a cash flow hedge; prepare journal entries for this sales transaction and forward contract.

Definitions:

Degrees of Freedom

The number of independent pieces of information available to estimate another piece of information or parameter within a dataset.

ANOVA Table

A table used in analysis of variance that displays the sources of variability in the data, including the sum of squares, degrees of freedom, mean squares, and the F-statistic.

P-value

The chance of encountering a test statistic that is as or more extreme than the observed one, given that the null hypothesis is considered to be correct.

Color Brightness

A measure of the perceptual intensity of a color, often associated with its luminance or the amount of light it emits or reflects.

Q3: U.S. GAAP provides guidance for hedges of

Q36: Pigskin Co., a U.S. corporation, sold inventory

Q48: For a partnership, how should liquidation gains

Q50: Pell Company acquires 80% of Demers Company

Q67: An intra-entity sale took place whereby the

Q82: Brisco Bricks purchases raw material from its

Q83: The appropriate format of the December 31,

Q92: Cashen Co. paid $2,400,000 to acquire all

Q95: Stiller Company, an 80% owned subsidiary of

Q106: Following are selected accounts for Green Corporation