These questions are based on the following information and should be viewed as independent situations.

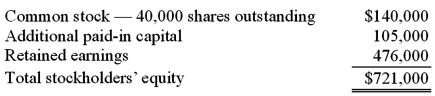

Popper Co. acquired 80% of the common stock of Cocker Co. on January 1, 2009, when Cocker had the following stockholders' equity accounts.

To acquire this interest in Cocker, Popper paid a total of $682,000 with any excess acquisition date fair value over book value being allocated to goodwill, which has been measured for impairment annually and has not been determined to be impaired as of January 1, 2012.

On January 1, 2012, Cocker reported a net book value of $1,113,000 before the following transactions were conducted. Popper uses the equity method to account for its investment in Cocker, thereby reflecting the change in book value of Cocker.

On January 1, 2012, Cocker reacquired 8,000 of the outstanding shares of its own common stock for $34 per share. None of these shares belonged to Popper. How would this transaction have affected the additional paid-in capital of the parent company?

Definitions:

Probability Sampling

A sampling method in which every member of a population has a known and typically equal chance of being selected for research or survey.

Target Population

The specific group of individuals that a research study or marketing campaign is designed to analyze or reach.

Simple Random Sampling

A statistical sampling technique in which each member of a population has an equal chance of being included in the sample.

Streaming Service

A platform that delivers content, such as music, movies, or television shows, over the internet, enabling users to access it on-demand.

Q17: On July 12, 2011, Fred City ordered

Q27: Dutch Co. has loaned $90,000 to its

Q36: Following are selected accounts for Green Corporation

Q37: The City of Wetteville has a fiscal

Q37: Beta Corp. owns less than one hundred

Q63: What accounting method requires a subsidiary to

Q69: Ryan Company owns 80% of Chase Company.

Q71: What documents or other sources of information

Q94: For each of the following situations, select

Q106: Following are selected accounts for Green Corporation