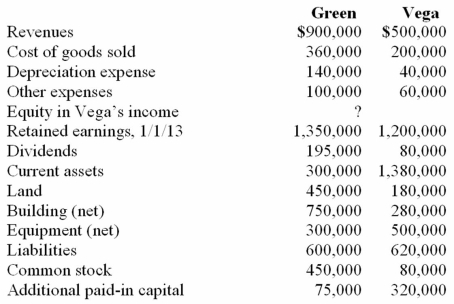

Following are selected accounts for Green Corporation and Vega Company as of December 31, 2013. Several of Green's accounts have been omitted.

Green acquired 100% of Vega on January 1, 2009, by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share. On January 1, 2009, Vega's land was undervalued by $40,000, its buildings were overvalued by $30,000, and equipment was undervalued by $80,000. The buildings have a 20-year life and the equipment has a 10-year life. $50,000 was attributed to an unrecorded trademark with a 16-year remaining life. There was no goodwill associated with this investment.

Compute the December 31, 2013, consolidated common stock.

Definitions:

Patient

An individual who is receiving medical care or treatment from healthcare professionals.

Standardized Care Plan

A structured approach to patient care that outlines specific interventions and expected outcomes, based on evidence and best practices.

Individualizing

Tailoring approaches, interventions, or treatments to meet the specific needs or characteristics of an individual.

Impaired Walking

Difficulty or inability to walk normally due to physical or neurological conditions, affecting mobility and independence.

Q13: The financial balances for the Atwood Company

Q29: On March 1, 2011, Mattie Company received

Q33: Approximately what mass ratio is required for

Q35: Pell Company acquires 80% of Demers Company

Q37: In principle, we could accelerate a matter-antimatter

Q73: On January 4, 2011, Mason Co. purchased

Q74: Perry Company acquires 100% of the stock

Q90: Flynn acquires 100 percent of the outstanding

Q93: Gargiulo Company, a 90% owned subsidiary of

Q106: The following are preliminary financial statements for