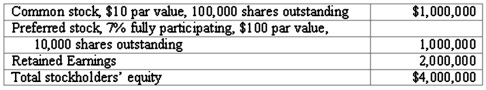

On January 1, 2011, Harrison Corporation spent $2,600,000 to acquire control over Involved, Inc. This price was based on paying $750,000 for 30 percent of Involved's preferred stock, and $1,850,000 for 80 percent of its outstanding common stock. As of the date of the acquisition, Involved's stockholders' equity accounts were as follows:

Assuming Involved's accounts are correctly valued within the company's financial statements, what amount of goodwill should be recognized for the Investment in Involved?

Definitions:

CTRL+V

This is the keyboard shortcut commonly used for pasting copied content from the clipboard into a document or input field in many computer applications.

Active Worksheet

The worksheet currently being displayed and edited within spreadsheet or document editing software.

Settings Area

A section within software or an operating system where users can configure options, preferences, and manage various features.

Header

Text or graphic printed at the top of every page in a document or appearing at the beginning of a section online.

Q9: When a parent uses the equity method

Q22: For each of the following situations (1

Q34: On January 1, 20X1, the Moody Company

Q43: On January 1, 2011, Payton Co. sold

Q60: Under the current rate method, retained earnings

Q65: On October 1, 2011, Eagle Company forecasts

Q68: Clemente Co. owned all of the voting

Q79: Cleary, Wasser, and Nolan formed a partnership

Q85: The ABCD Partnership has the following balance

Q119: What is the basic objective of all