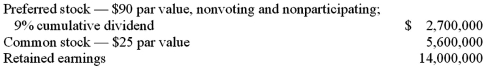

Thomas Inc. had the following stockholders' equity accounts as of January 1, 2011:

Kuried Co. acquired all of the voting common stock of Thomas on January 1, 2011, for $20,656,000. The preferred stock remained in the hands of outside parties and had a fair value of $3,060,000. A database valued at $656,000 was recognized and amortized over five years.

During 2011, Thomas reported earning $630,000 in net income and paid $504,000 in total cash dividends. Kuried used the equity method to account for this investment.

What was the non-controlling interest's share of consolidated net income for the year 2011?

Definitions:

Budget Surpluses

An excess of income or revenues over expenditures in a given period, meaning the government or organization has more money than it spends.

Automatic Stabilizer

An Automatic Stabilizer is an economic policy or program designed to offset fluctuations in a nation's economic activity without intervention by the government or policymakers, such as progressive taxes and welfare.

Unemployment Compensation

Financial payments made by the government to unemployed individuals who are actively seeking work but have not found employment.

Social Security Taxes

Taxes collected by governments to fund social security programs, including retirement benefits, disability insurance, and survivor benefits.

Q10: Which of the following statements is true

Q23: Perez Company, a Mexican subsidiary of a

Q49: Peter, Roberts, and Dana have the following

Q56: Darron Co. was formed on January 1,

Q61: Flynn acquires 100 percent of the outstanding

Q64: Perry Company acquires 100% of the stock

Q66: Which of the following statements is true?<br>A)

Q70: Flynn acquires 100 percent of the outstanding

Q109: Perry Company acquires 100% of the stock

Q111: Parent Corporation acquired some of its subsidiary's