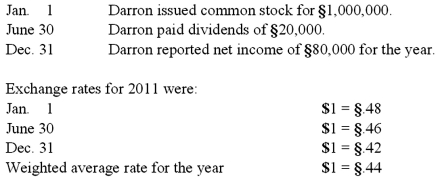

Darron Co. was formed on January 1, 2011 as a wholly owned foreign subsidiary of a U.S. corporation. Darron's functional currency was the stickle (§) . The following transactions and events occurred during 2011:

What exchange rate should have been used in translating Darron's revenues and expenses for 2011?

Definitions:

Voting Shares

Shares of stock that grant the shareholder the right to vote on matters of corporate policy and the election of board members.

Fair Values

The estimated market value of an asset or liability, based on current conditions and knowledgeable, willing parties' transactions.

Book Values

The value of an asset as reported on the balance sheet, calculated as the original cost of the asset minus any depreciation, amortization, or impairment costs.

Gain or Loss

The financial result of disposing of an asset or settling a liability for more or less than its carrying amount.

Q4: Which of the following statements is true

Q38: On March 1, 2011, Mattie Company received

Q44: When a city received a private donation

Q52: Gargiulo Company, a 90% owned subsidiary of

Q68: Hardin, Sutton, and Williams have operated a

Q72: At work a phone call should be

Q79: Which of the following statements is true

Q80: The partnership contract for Hanes and Jones

Q89: In translating a foreign subsidiary's financial statements,

Q95: Under the temporal method, depreciation expense would