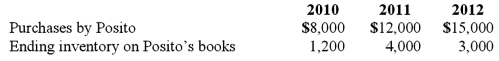

Gargiulo Company, a 90% owned subsidiary of Posito Corporation, sells inventory to Posito at a 25% profit on selling price. The following data are available pertaining to intra-entity purchases. Gargiulo was acquired on January 1, 2010.

Assume the equity method is used. The following data are available pertaining to Gargiulo's income and dividends.

Compute the non-controlling interest in Gargiulo's net income for 2011.

Definitions:

Federal Unemployment

Refers to the United States federal government program that provides unemployment benefits to eligible workers.

FICA-OASDI

Refers to the Social Security portion of the Federal Insurance Contributions Act tax, used to fund the Social Security program in the United States.

Calendar Year

The 12-month period a business chooses for its accounting year. Alternatively known as fiscal year and natural business year.

State Unemployment Tax Rate

The rate at which employers are taxed by their state government to fund unemployment insurance benefits for laid-off workers.

Q6: Goehler, Inc. acquires all of the voting

Q15: Cashen Co. paid $2,400,000 to acquire all

Q22: Gaw Produce Company purchased inventory from a

Q43: On January 1, 2011, Payton Co. sold

Q43: On January 1, 2010, Palk Corp. and

Q50: Yukon Co. acquired 75% percent of the

Q66: What is the purpose of a predistribution

Q78: All of the following data may be

Q86: Esposito is an Italian subsidiary of a

Q115: Denber Co. acquired 60% of the common