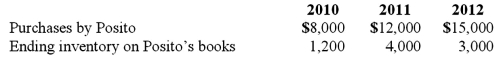

Gargiulo Company, a 90% owned subsidiary of Posito Corporation, sells inventory to Posito at a 25% profit on selling price. The following data are available pertaining to intra-entity purchases. Gargiulo was acquired on January 1, 2010.

Assume the equity method is used. The following data are available pertaining to Gargiulo's income and dividends.

For consolidation purposes, what amount would be debited to cost of goods sold for the 2011 consolidation worksheet with regard to the unrealized gross profit of the 2011 intra-entity transfer of merchandise?

Definitions:

Net Present Value

A valuation method that calculates the worth of a future stream of cash flows by discounting them back to their present value.

IRR

Internal Rate of Return; a financial metric used to estimate the profitability of potential investments, calculating an annual growth rate.

Profitability Index

A fiscal indicator that evaluates an investment's comparative profitability by calculating the ratio of the present value of future cash inflows to the upfront cost of the investment.

Present Value

The immediate worth of a future financial amount or sequences of cash flows, using a specified rate of return for calculation.

Q21: Campbell Inc. owned all of Gordon Corp.

Q43: On January 1, 2011, Pacer Company paid

Q45: McGuire Company acquired 90 percent of Hogan

Q55: Woolsey Corporation, a U.S. company, expects to

Q61: Jones, Marge, and Tate LLP decided to

Q74: Dodge, Incorporated acquires 15% of Gates Corporation

Q90: Coyote Corp. (a U.S. company in Texas)

Q91: Fargus Corporation owned 51% of the voting

Q101: Which of the following statements is true

Q103: Following are selected accounts for Green Corporation