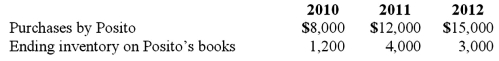

Gargiulo Company, a 90% owned subsidiary of Posito Corporation, sells inventory to Posito at a 25% profit on selling price. The following data are available pertaining to intra-entity purchases. Gargiulo was acquired on January 1, 2010.

Assume the equity method is used. The following data are available pertaining to Gargiulo's income and dividends.

For consolidation purposes, what amount would be debited to cost of goods sold for the 2010 consolidation worksheet with regard to unrealized gross profit of the intra-entity transfer of merchandise?

Definitions:

Commercial Bank

A financial institution that offers services such as accepting deposits, providing loans, and offering basic investment products to the public.

Strictly Business

Attitudes or actions that are focused solely on business matters, usually implying a formal or serious approach.

Mental Effort

Mental Effort is the cognitive labor involved in processing information, solving problems, or comprehending complex concepts.

Lie Frequently

The habitual act of providing false statements or misrepresentations of the truth.

Q29: Which of the following is a not

Q29: On April 7, 2011, Pate Corp. sold

Q31: Following are selected accounts for Green Corporation

Q34: On January 1, 2011, the partners of

Q36: Following are selected accounts for Green Corporation

Q40: Perch Co. acquired 80% of the common

Q44: When preparing a consolidation worksheet for a

Q53: Flintstone Inc. acquired all of Rubble Co.

Q91: On January 1, 2011, Jackie Corp. purchased

Q102: Virginia Corp. owned all of the voting