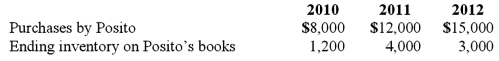

Gargiulo Company, a 90% owned subsidiary of Posito Corporation, sells inventory to Posito at a 25% profit on selling price. The following data are available pertaining to intra-entity purchases. Gargiulo was acquired on January 1, 2010.

Assume the equity method is used. The following data are available pertaining to Gargiulo's income and dividends.

Compute the non-controlling interest in Gargiulo's net income for 2011.

Definitions:

Variable Costs

Costs that vary directly with the level of business activity.

Variable Costs

Costs that vary in total directly and proportionately with changes in the activity level or volume of output.

Financial Advantage

The benefit or edge that a business or individual has that allows them to generate more income or wealth compared to others.

Fixed Manufacturing Overhead

Regular, consistent expenses that do not vary with production levels, such as salaries of supervisors and rent for factory facilities.

Q2: On May 1, 2011, Mosby Company received

Q46: Pepe, Incorporated acquired 60% of Devin Company

Q54: Kennedy Company acquired all of the outstanding

Q55: Pell Company acquires 80% of Demers Company

Q71: The financial balances for the Atwood Company

Q77: Brown and Green are forming a business

Q90: Parker owned all of Odom Inc. Although

Q92: Under what circumstances would the remeasurement of

Q110: Acquired in-process research and development is considered

Q121: Wilson owned equipment with an estimated life