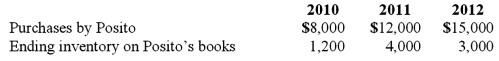

Gargiulo Company, a 90% owned subsidiary of Posito Corporation, sells inventory to Posito at a 25% profit on selling price. The following data are available pertaining to intra-entity purchases. Gargiulo was acquired on January 1, 2010.

Assume the equity method is used. The following data are available pertaining to Gargiulo's income and dividends.

For consolidation purposes, what amount would be debited to January 1 retained earnings for the 2011 consolidation worksheet entry with regard to the unrealized gross profit of the 2010 intra-entity transfer of merchandise?

Definitions:

CCC

Refers to the Cash Conversion Cycle, a metric that gauges how efficiently a company manages its inventory, receivables, and payables to generate cash.

Peak Borrowing Needs

The maximum amount of capital a business or individual will need to borrow to meet its financial obligations.

Monthly Cash Budget

A financial plan projecting cash inflows and outflows on a monthly basis, used by companies to ensure liquidity and financial stability.

Costly Trade Credit

Credit taken in excess of free trade credit whose cost is equal to the discount lost.

Q23: How are bargain purchases accounted for in

Q34: Strickland Company sells inventory to its parent,

Q35: Assume the partnership of Dean, Hardin, and

Q52: Carnes has the following account balances as

Q55: Darron Co. was formed on January 1,

Q61: A partnership began its first year of

Q84: Which of the following is not a

Q86: Carnes Co. decided to use the partial

Q109: Panton, Inc. acquired 18,000 shares of Glotfelty

Q118: Watkins, Inc. acquires all of the outstanding