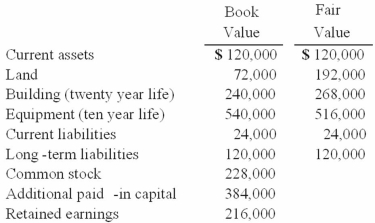

On January 1, 2010, Cale Corp. paid $1,020,000 to acquire Kaltop Co. Kaltop maintained separate incorporation. Cale used the equity method to account for the investment. The following information is available for Kaltop's assets, liabilities, and stockholders' equity accounts:

Kaltop earned net income for 2010 of $126,000 and paid dividends of $48,000 during the year.

If Cale Corp. had net income of $444,000 in 2010, exclusive of the investment, what is the amount of consolidated net income?

Definitions:

Oppressive Conduct

Actions by major stakeholders in a corporation that unfairly prejudice the interests of minority shareholders.

Articles Of Incorporation

Legal documents filed with a governmental body to legally document the creation of a corporation, detailing key aspects such as name, purpose, and structure.

Bylaws

Written rules and regulations adopted by an organization or community to govern its actions and ensure structured management.

Corporate Assets

All tangible and intangible assets owned by a corporation, including cash, property, intellectual property, and goodwill, used in the operation of the business.

Q10: What is the name of the research

Q15: Which statement is true concerning unrealized profits

Q38: Thomas Inc. had the following stockholders' equity

Q38: On March 1, 2011, Mattie Company received

Q40: Perry Company acquires 100% of the stock

Q42: On January 1, 2010, Cale Corp. paid

Q57: What happens when a U.S. company purchases

Q66: A company has a discount on a

Q96: The following information has been taken from

Q110: How does the partial equity method differ