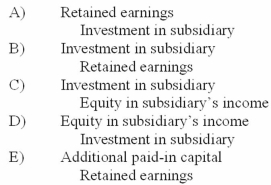

When a company applies the initial method in accounting for its investment in a subsidiary and the subsidiary reports income in excess of dividends paid, what entry would be made for a consolidation worksheet?

Definitions:

Federal Income Tax

The annual income of individuals, corporations, trusts, and other legal entities is subject to a tax imposed by the IRS.

Monthly Schedule Depositor

A designation for businesses that are required to deposit employment taxes on a monthly basis, typically when their tax liability in a lookback period exceeds certain thresholds.

Tax Liability

The total amount of tax owed to the IRS or other tax authorities after all deductions, credits, and exemptions.

Semiweekly Depositor

A semiweekly depositor is a business that must deposit employment taxes on Wednesdays or Fridays, depending on the day wages are paid, due to the size of its payroll.

Q6: On January 1, 2009, Dermot Company purchased

Q13: On January 1, 2010, Glenville Co. acquired

Q13: Any reply to a detected SETI signal

Q17: Perch Co. acquired 80% of the common

Q23: How are bargain purchases accounted for in

Q29: Which of the following is a not

Q44: Johnson, Inc. owns control over Kaspar, Inc.

Q57: Royce Co. acquired 60% of Park Co.

Q99: On January 1, 20X1, the Moody Company

Q106: Ryan Company owns 80% of Chase Company.