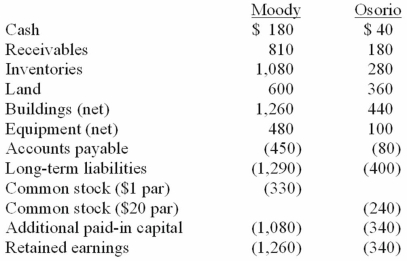

On January 1, 20X1, the Moody Company entered into a transaction for 100% of the outstanding common stock of Osorio Company. To acquire these shares, Moody issued $400 in long-term liabilities and 40 shares of common stock having a par value of $1 per share but a fair value of $10 per share. Moody paid $20 to lawyers, accountants, and brokers for assistance in bringing about this acquisition. Another $15 was paid in connection with stock issuance costs. Prior to these transactions, the balance sheets for the two companies were as follows:

Note: Parentheses indicate a credit balance.

In Moody's appraisal of Osorio, three assets were deemed to be undervalued on the subsidiary's books: Inventory by $10, Land by $40, and Buildings by $60.

Compute the amount of consolidated additional paid-in capital at date of acquisition.

Definitions:

Maslow's Hierarchy

A theory in psychology that prioritizes human needs in a pyramid structure, starting from basic physiological needs to self-actualization at the top.

Arousal Theory

A theory that suggests people are motivated to maintain an optimal level of arousal, which varies from one individual to another.

Social Networking Sites

Websites or platforms where individuals can create profiles, share information, and interact with others to maintain social connections.

Instinct Theories

Theories that explain human behavior as motivated by automatic, involuntary, and unlearned responses.

Q3: The ultimate speed of a solar-sail-propelled spacecraft

Q15: Europa is located outside the Sun's habitable

Q31: A Lagrange point in the Earth-Moon system

Q37: Stark Company, a 90% owned subsidiary of

Q44: A UFO is<br>A) an unidentified object seen

Q55: On January 1, 2011, Pride, Inc. acquired

Q57: Which of the following statements is true

Q74: MacDonald, Inc. owns 80 percent of the

Q75: Ryan Company owns 80% of Chase Company.

Q118: For each of the following numbered situations