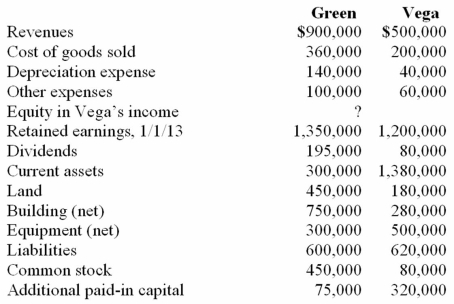

Following are selected accounts for Green Corporation and Vega Company as of December 31, 2013. Several of Green's accounts have been omitted.

Green acquired 100% of Vega on January 1, 2009, by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share. On January 1, 2009, Vega's land was undervalued by $40,000, its buildings were overvalued by $30,000, and equipment was undervalued by $80,000. The buildings have a 20-year life and the equipment has a 10-year life. $50,000 was attributed to an unrecorded trademark with a 16-year remaining life. There was no goodwill associated with this investment.

Compute the December 31, 2013, consolidated common stock.

Definitions:

Economic Profit

The difference between total revenues and total costs, including both explicit and implicit costs, representing the additional benefit over the next best alternative.

Market Price

The price of a commodity when sold in a competitive marketplace, reflecting the supply and demand balance.

Units

Basic measures or quantities of a product, service, or variable used in economic analysis or transactions.

Average Fixed Cost

The average fixed cost is the total fixed expenses of a business divided by the number of units produced, showing how much fixed costs contribute to each unit of production.

Q1: On January 3, 2011, Roberts Company purchased

Q15: The search for radio signals from intelligent

Q17: Perch Co. acquired 80% of the common

Q46: Yelton Co. just sold inventory for 80,000

Q46: Pepe, Incorporated acquired 60% of Devin Company

Q48: On January 1, 2011, Jackie Corp. purchased

Q65: Goehler, Inc. acquires all of the voting

Q94: For each of the following situations, select

Q97: On January 1, 2010, Jannison Inc. acquired

Q99: On January 1, 20X1, the Moody Company