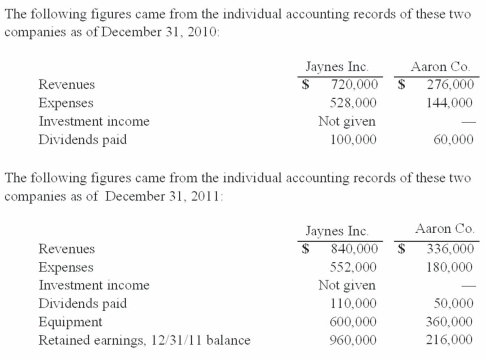

Jaynes Inc. acquired all of Aaron Co.'s common stock on January 1, 2010, by issuing 11,000 shares of $1 par value common stock. Jaynes' shares had a $17 per share fair value. On that date, Aaron reported a net book value of $120,000. However, its equipment (with a five-year remaining life) was undervalued by $6,000 in the company's accounting records. Any excess of consideration transferred over fair value of assets and liabilities is assigned to an unrecorded patent to be amortized over ten years.

What was the total for consolidated patents as of December 31, 2011?

Definitions:

Modeling

A learning method where individuals ascertain how to act or perform by observing others, often used in cognitive psychology and behavioral analysis.

Surgery

A branch of medicine that involves the treatment of diseases, injuries, or deformations by manual or operative procedures.

Behavior Modification

A form of therapy that applies the principles of reinforcement to bring about desired behavioral changes.

Socially Undesirable

Behaviors or traits that are frowned upon by society or considered inappropriate or unacceptable.

Q1: Pepe, Incorporated acquired 60% of Devin Company

Q25: On January 1, 2011, Jordan Inc. acquired

Q29: Which of the following is a not

Q34: Strickland Company sells inventory to its parent,

Q65: Where do dividends paid to the non-controlling

Q81: A company has been using the equity

Q84: Perry Company acquires 100% of the stock

Q100: Following are selected accounts for Green Corporation

Q102: On January 3, 2011, Roberts Company purchased

Q105: Which of the following is not an