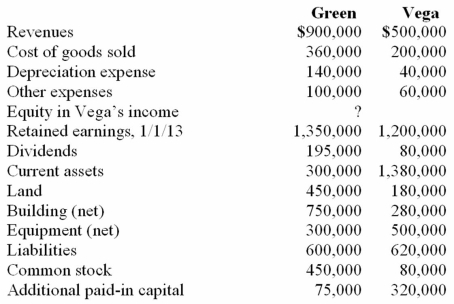

Following are selected accounts for Green Corporation and Vega Company as of December 31, 2013. Several of Green's accounts have been omitted.

Green acquired 100% of Vega on January 1, 2009, by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share. On January 1, 2009, Vega's land was undervalued by $40,000, its buildings were overvalued by $30,000, and equipment was undervalued by $80,000. The buildings have a 20-year life and the equipment has a 10-year life. $50,000 was attributed to an unrecorded trademark with a 16-year remaining life. There was no goodwill associated with this investment.

Compute the December 31, 2013, consolidated buildings.

Definitions:

Therapeutic Relationship

A bond between a therapist and client that serves as the foundation for treatment, facilitating client engagement, trust, and openness.

Solution-Focused Therapists

Therapists who adopt a goal-directed approach, focusing on solutions and preferred futures rather than dwelling on past problems.

Interactive Dialogue

A reciprocal communication process in which participants exchange information, feelings, and meaning through verbal and non-verbal messages.

Narrative Therapists

Practitioners of a therapeutic approach that seeks to help patients identify their values and the skills associated with them in order to live these values so they can effectively confront current and future problems.

Q16: Which of the following is not a

Q25: Pell Company acquires 80% of Demers Company

Q29: How would a change be made from

Q30: Dithers Inc. acquired all of the common

Q45: When our Sun becomes a red giant

Q45: Presented below are the financial balances for

Q51: Watkins, Inc. acquires all of the outstanding

Q57: Beatty, Inc. acquires 100% of the voting

Q64: Charlie Co. owns 30% of the voting

Q127: Pepe, Incorporated acquired 60% of Devin Company