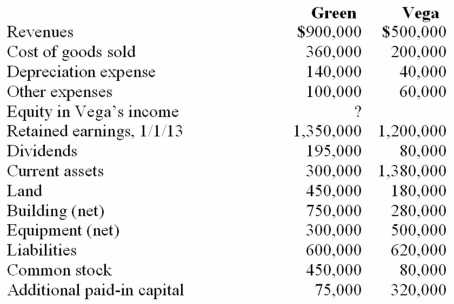

Following are selected accounts for Green Corporation and Vega Company as of December 31, 2013. Several of Green's accounts have been omitted.

Green acquired 100% of Vega on January 1, 2009, by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share. On January 1, 2009, Vega's land was undervalued by $40,000, its buildings were overvalued by $30,000, and equipment was undervalued by $80,000. The buildings have a 20-year life and the equipment has a 10-year life. $50,000 was attributed to an unrecorded trademark with a 16-year remaining life. There was no goodwill associated with this investment.

Compute the December 31, 2013, consolidated land.

Definitions:

Objectionable Material

Content that is considered offensive, problematic, or inappropriate, often leading to censorship or restrictions.

North American Free Trade Agreement

A trilateral trade block agreement signed by Canada, Mexico, and the United States, aimed at reducing trading costs, increasing business investment, and helping North America be more competitive in the global marketplace.

Global Trade

International commerce that allows for the exchange of goods and services between countries, influenced by agreements, tariffs, and global economic conditions.

Canada and Mexico

Two countries in North America, each having distinct cultures, economies, and political systems, but are partners with the United States in trade agreements such as the USMCA.

Q21: On October 1, 2011, Eagle Company forecasts

Q24: If we accelerate a radioactive isotope of

Q35: Car Corp. (a U.S.-based company) sold parts

Q39: Which of the following is false regarding

Q43: The financial balances for the Atwood Company

Q52: The theory of relativity predicts that everything

Q61: Pell Company acquires 80% of Demers Company

Q76: Gargiulo Company, a 90% owned subsidiary of

Q78: Parent Corporation had just purchased some of

Q96: Stark Company, a 90% owned subsidiary of