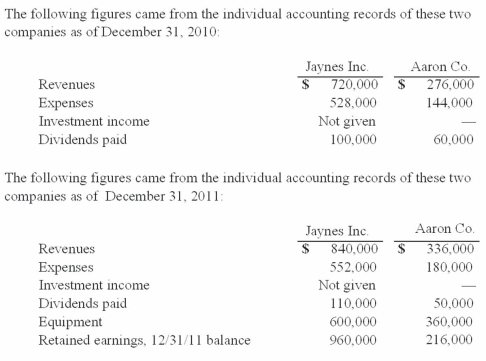

Jaynes Inc. acquired all of Aaron Co.'s common stock on January 1, 2010, by issuing 11,000 shares of $1 par value common stock. Jaynes' shares had a $17 per share fair value. On that date, Aaron reported a net book value of $120,000. However, its equipment (with a five-year remaining life) was undervalued by $6,000 in the company's accounting records. Any excess of consideration transferred over fair value of assets and liabilities is assigned to an unrecorded patent to be amortized over ten years.

What was consolidated net income for the year ended December 31, 2011?

Definitions:

Trademark Infringement

The illicit application of a trademark or service mark to products and/or services without permission, in a way that may lead to confusion, deceit, or error regarding the origin of those goods and/or services.

Efficient Shoppers

Refers to consumers who maximize their shopping experience by making well-informed and cost-effective choices.

Branding

The process of creating a unique image, name, and identity for a product or service in the consumer's mind through marketing strategies.

Lanham Act

United States federal legislation that governs trademarks, service marks, and unfair competition.

Q8: Jager Inc. holds 30% of the outstanding

Q10: On January 4, 2010, Trycker, Inc. acquired

Q24: If we accelerate a radioactive isotope of

Q27: What do we know for certain about

Q40: The financial statements for Goodwin, Inc., and

Q44: How might the inward migration of a

Q64: The maximum terminal velocity we could accelerate

Q70: Flynn acquires 100 percent of the outstanding

Q99: The recently discovered rocky terrestrial-like exoplanets with

Q105: Flynn acquires 100 percent of the outstanding