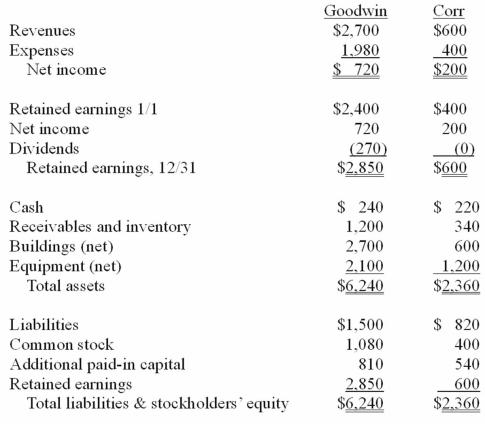

The financial statements for Goodwin, Inc., and Corr Company for the year ended December 31, 20X1, prior to Goodwin's acquisition business combination transaction regarding Corr, follow (in thousands) :

On December 31, 20X1, Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to acquire all of the outstanding shares of that company. Goodwin shares had a fair value of $40 per share.

Goodwin paid $25 to a broker for arranging the transaction. Goodwin paid $35 in stock issuance costs. Corr's equipment was actually worth $1,400 but its buildings were only valued at $560.

Compute the consolidated revenues for 20X1.

Definitions:

Competitive Advantage

The unique attributes or capabilities that allow an organization to outperform its competitors, often leading to market dominance.

Business Performance

An evaluation of a company's operations and financial results, which indicates how well it achieves its objectives and competes in the market.

Management Tools

Various systems, software, practices, and methodologies that help in planning, executing, monitoring, and analyzing an organization's operations.

Test Marketing Techniques

Strategic approaches used by businesses to evaluate the market response to a product or service in a limited geographical area or demographically before a full-scale launch.

Q21: Matthews Co. acquired all of the common

Q48: Which type of electromagnetic radiation is able

Q65: The most likely method of interstellar communication

Q70: Why might it be difficult for Earth-like

Q80: Parent Corporation loaned money to its subsidiary

Q82: On January 1, 20X1, the Moody Company

Q88: Jansen Inc. acquired all of the outstanding

Q90: Parker owned all of Odom Inc. Although

Q92: Which statement is true concerning unrealized profits

Q102: Pennant Corp. owns 70% of the common