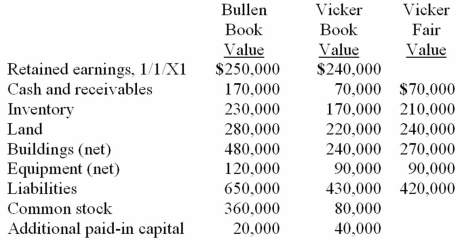

Bullen Inc. acquired 100% of the voting common stock of Vicker Inc. on January 1, 20X1. The book value and fair value of Vicker's accounts on that date (prior to creating the combination) follow, along with the book value of Bullen's accounts:

Assume that Bullen issued 12,000 shares of common stock with a $5 par value and a $42 fair value for all of the outstanding shares of Vicker. What will be the consolidated Additional Paid-In Capital and Retained Earnings (January 1, 20X1 balances) as a result of this acquisition transaction?

Definitions:

Nadler and Tushman

Researchers who developed the Congruence Model, a framework for analyzing organizational performance by examining the alignment among different elements, such as work, people, structure, and culture.

Top-level Managers

Senior executives responsible for making strategic decisions and overseeing the entire organization's operation.

5P Checklist

A structured framework for evaluating projects or tasks based on five key aspects: Purpose, People, Process, Product, and Progress.

Persistence

The continued effort to do or achieve something despite difficulties, failure, or opposition.

Q8: Jager Inc. holds 30% of the outstanding

Q16: When consolidating a subsidiary under the equity

Q23: How are bargain purchases accounted for in

Q23: B-type stars have lifetimes<br>A) long enough for

Q40: Acker Inc. bought 40% of Howell Co.

Q46: On January 1, 2011, Parent Corporation acquired

Q60: The object recovered from a pasture close

Q80: A statutory merger is a(n)<br>A) business combination

Q102: The balance sheets of Butler, Inc. and

Q103: On January 1, 2011, Riley Corp. acquired