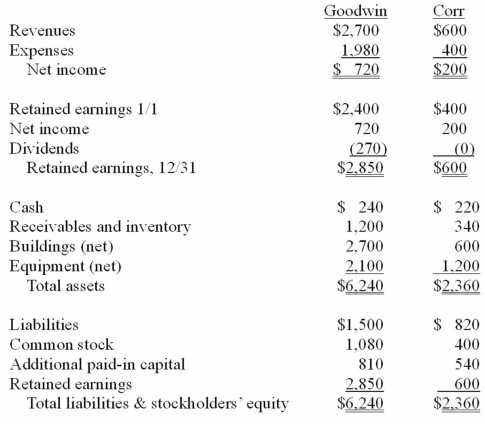

The financial statements for Goodwin, Inc., and Corr Company for the year ended December 31, 20X1, prior to Goodwin's acquisition business combination transaction regarding Corr, follow (in thousands) :

On December 31, 20X1, Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to acquire all of the outstanding shares of that company. Goodwin shares had a fair value of $40 per share.

Goodwin paid $25 to a broker for arranging the transaction. Goodwin paid $35 in stock issuance costs. Corr's equipment was actually worth $1,400 but its buildings were only valued at $560.

In this acquisition business combination, what total amount of common stock and additional paid-in capital is recorded on Goodwin's books?

Definitions:

Call Option

A financial contract giving the buyer the right, but not the obligation, to buy an asset at a specified price within a specific time.

Expiration

The end of the effective period of a contract, policy, or agreement, often referring to options, futures, or insurance contracts.

Grill Parts Kit

A set of components used for the maintenance, repair, or assembly of a grill.

Washers

are thin plates with a hole, typically used to distribute the load of a threaded fastener, such as a screw or nut.

Q5: One company buys a controlling interest in

Q14: What type of civilization would be able

Q21: Gargiulo Company, a 90% owned subsidiary of

Q29: How would a change be made from

Q35: The Declaration of Principles Concerning Activities Following

Q54: Compared to a chemical rocket, an ion

Q54: When an investor sells shares of its

Q84: The financial balances for the Atwood Company

Q93: Pell Company acquires 80% of Demers Company

Q107: Hoyt Corporation agreed to the following terms