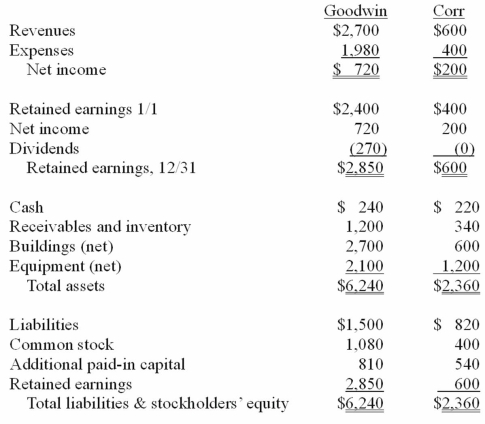

The financial statements for Goodwin, Inc., and Corr Company for the year ended December 31, 20X1, prior to Goodwin's acquisition business combination transaction regarding Corr, follow (in thousands) :

On December 31, 20X1, Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to acquire all of the outstanding shares of that company. Goodwin shares had a fair value of $40 per share.

Goodwin paid $25 to a broker for arranging the transaction. Goodwin paid $35 in stock issuance costs. Corr's equipment was actually worth $1,400 but its buildings were only valued at $560.

Compute the consolidated receivables and inventory for 20X1.

Definitions:

Subagent

An agent appointed by another agent with the original principal's authorization, typically to help perform some duty or function.

Apparent Authority

The appearance or assumption of authority based on the actions or representations of the principal.

Misrepresented Warranty

A false or misleading statement about the condition or functionality of a product that can lead to a breach of warranty claim.

Respondeat Superior

A legal doctrine that holds an employer liable for the actions of an employee when the actions occur within the scope of employment.

Q7: Chapel Hill Company had common stock of

Q24: On January 4, 2010, Harley, Inc. acquired

Q30: The range of distances that has remained

Q57: Beatty, Inc. acquires 100% of the voting

Q61: The center of mass of the solar

Q77: Describe the accounting for direct costs, indirect

Q78: On January 4, 2011, Mason Co. purchased

Q87: An intra-entity sale took place whereby the

Q90: On January 1, 2011, Deuce Inc. acquired

Q109: Wilson owned equipment with an estimated life