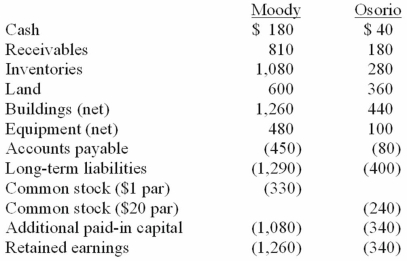

On January 1, 20X1, the Moody Company entered into a transaction for 100% of the outstanding common stock of Osorio Company. To acquire these shares, Moody issued $400 in long-term liabilities and 40 shares of common stock having a par value of $1 per share but a fair value of $10 per share. Moody paid $20 to lawyers, accountants, and brokers for assistance in bringing about this acquisition. Another $15 was paid in connection with stock issuance costs. Prior to these transactions, the balance sheets for the two companies were as follows:

Note: Parentheses indicate a credit balance.

In Moody's appraisal of Osorio, three assets were deemed to be undervalued on the subsidiary's books: Inventory by $10, Land by $40, and Buildings by $60.

Compute the amount of consolidated additional paid-in capital at date of acquisition.

Definitions:

Humanistic Therapy

A psychological treatment approach focusing on individual potential and emphasizing empathy and the good in human behavior.

Stress Inoculation Training

A psychotherapy method that helps individuals cope with stress by preparing them in advance to manage potential stressors.

Anxiety-producing Situations

Scenarios or circumstances that trigger feelings of anxiety, fear, or apprehension, varying widely among individuals based on personal experiences and sensitivities.

Cognitive Therapy

A form of psychotherapy that addresses maladaptive thinking patterns to effect change in behavior and emotion, often used in treating depression and anxiety.

Q26: Cayman Inc. bought 30% of Maya Company

Q27: If we do nothing to slow our

Q30: When the fair value option is elected

Q43: On January 1, 2011, Payton Co. sold

Q49: What argument could be made against the

Q66: On 4/1/09, Sey Mold Corporation acquired 100%

Q87: McGuire Company acquired 90 percent of Hogan

Q115: At the date of an acquisition which

Q118: Stiller Company, an 80% owned subsidiary of

Q120: Watkins, Inc. acquires all of the outstanding