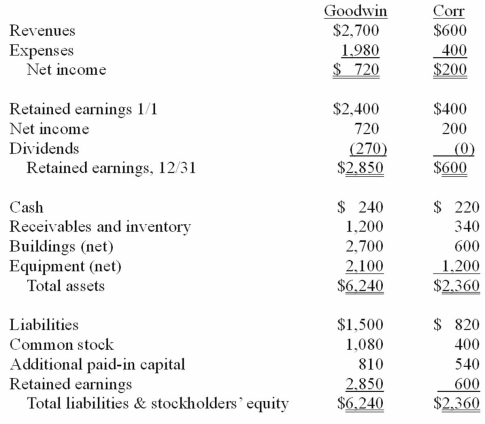

The financial statements for Goodwin, Inc., and Corr Company for the year ended December 31, 20X1, prior to Goodwin's acquisition business combination transaction regarding Corr, follow (in thousands) :

On December 31, 20X1, Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to acquire all of the outstanding shares of that company. Goodwin shares had a fair value of $40 per share.

Goodwin paid $25 to a broker for arranging the transaction. Goodwin paid $35 in stock issuance costs. Corr's equipment was actually worth $1,400 but its buildings were only valued at $560.

Compute the consolidated expenses for 20X1.

Definitions:

Motor Vehicle Accidents

Incidents involving collision or other damaging events between vehicles, often leading to injury or death.

Tuberculosis

A contagious bacterial infection that primarily affects the lungs but may spread to other parts of the body, caused by Mycobacterium tuberculosis.

Measles

A highly contagious viral disease characterized by fever, cough, conjunctivitis, and a distinctive rash.

Diarrhea

A common condition characterized by frequent, loose, or watery bowel movements, often a symptom of infection or digestive issues.

Q9: What is the most common class of

Q28: Fargus Corporation owned 51% of the voting

Q36: The Earth's escape velocity is defined to

Q37: Imagine we have a planet identical to

Q38: Perry Company acquires 100% of the stock

Q57: Goehring, Inc. owns 70 percent of Harry,

Q87: Under the equity method, when the company's

Q91: The financial statements for Goodwin, Inc., and

Q109: Perry Company acquires 100% of the stock

Q114: Pot Co. holds 90% of the common