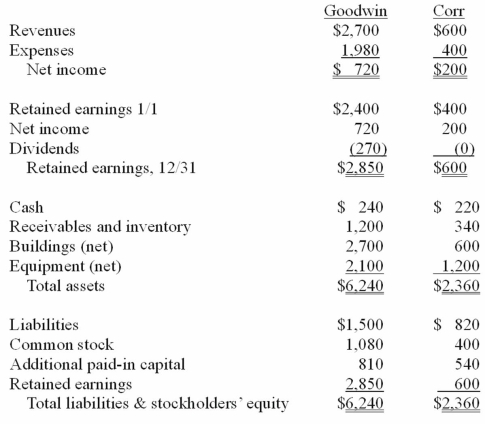

The financial statements for Goodwin, Inc., and Corr Company for the year ended December 31, 20X1, prior to Goodwin's acquisition business combination transaction regarding Corr, follow (in thousands) :

On December 31, 20X1, Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to acquire all of the outstanding shares of that company. Goodwin shares had a fair value of $40 per share.

Goodwin paid $25 to a broker for arranging the transaction. Goodwin paid $35 in stock issuance costs. Corr's equipment was actually worth $1,400 but its buildings were only valued at $560.

Compute the consolidated common stock account at December 31, 20X1.

Definitions:

Long-term Violence

Sustained acts of aggression or assault that occur over an extended period, often resulting in physical harm, psychological trauma, or social disruption.

Two-physician Certificates

Documents required in some legal or medical processes, confirming a patient's condition or need for a particular treatment, signed by two licensed physicians.

Involuntarily Committed

The process where individuals are placed into a psychiatric facility or treatment program without their consent, typically because they are deemed a danger to themselves or others.

Sexual Predator

A person who seeks to sexually exploit others, often through manipulation or coercion.

Q2: Yaro Company owns 30% of the common

Q5: Which of the following types of stars

Q10: The first modern SETI search by Frank

Q29: How would a change be made from

Q49: Wilson owned equipment with an estimated life

Q80: Pell Company acquires 80% of Demers Company

Q85: The following information has been taken from

Q87: McGuire Company acquired 90 percent of Hogan

Q99: On January 1, 20X1, the Moody Company

Q105: Throughout 2011, Cleveland Co. sold inventory to