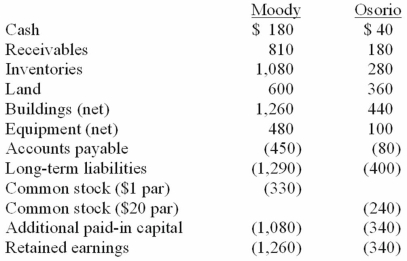

On January 1, 20X1, the Moody Company entered into a transaction for 100% of the outstanding common stock of Osorio Company. To acquire these shares, Moody issued $400 in long-term liabilities and 40 shares of common stock having a par value of $1 per share but a fair value of $10 per share. Moody paid $20 to lawyers, accountants, and brokers for assistance in bringing about this acquisition. Another $15 was paid in connection with stock issuance costs. Prior to these transactions, the balance sheets for the two companies were as follows:

Note: Parentheses indicate a credit balance.

In Moody's appraisal of Osorio, three assets were deemed to be undervalued on the subsidiary's books: Inventory by $10, Land by $40, and Buildings by $60.

What amount was recorded as goodwill arising from this acquisition?

Definitions:

Employee Training

The process by which employees are provided with the necessary knowledge and skills to perform their current jobs effectively or to acquire capabilities for new roles.

Corporations

Legal entities that are separate and distinct from their owners, providing limited liability protection to its shareholders.

Annually

Pertaining to something that occurs once every year or relating to a period of one year.

Web-Based Instruction

Educational content delivered via the internet, allowing remote access to learning resources and materials.

Q5: On January 2, 2011, Heinreich Co. paid

Q8: The maximum terminal velocity we could accelerate

Q14: Webb Co. acquired 100% of Rand Inc.

Q22: If the communication lifetime of civilizations in

Q28: Unlike the Earth, Venus does not have

Q69: Most of the extrasolar planets detected by

Q72: Why was the globular cluster M13 selected

Q72: How are intra-entity inventory transfers treated on

Q97: Flynn acquires 100 percent of the outstanding

Q100: Davidson, Inc. owns 70 percent of the