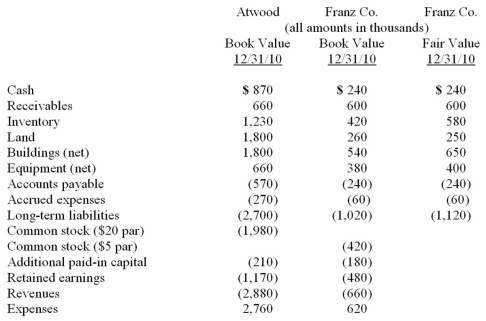

Presented below are the financial balances for the Atwood Company and the Franz Company as of December 31, 2010, immediately before Atwood acquired Franz. Also included are the fair values for Franz Company's net assets at that date.

Note: Parenthesis indicate a credit balance

Assume a business combination took place at December 31, 2010. Atwood issued 50 shares of its common stock with a fair value of $35 per share for all of the outstanding common shares of Franz. Stock issuance costs of $15 (in thousands) and direct costs of $10 (in thousands) were paid to effect this acquisition transaction. To settle a difference of opinion regarding Franz's fair value, Atwood promises to pay an additional $5.2 (in thousands) to the former owners if Franz's earnings exceed a certain sum during the next year. Given the probability of the required contingency payment and utilizing a 4% discount rate, the expected present value of the contingency is $5 (in thousands) .

Compute consolidated equipment at date of acquisition.

Definitions:

CNA Code of Ethics

A set of guiding principles designed to aid nurses in making ethical decisions in their professional practices.

Nursing Values

The core principles and beliefs that guide the practice and decision-making of nurses in providing care.

Advanced Directives

Legal documents that allow individuals to outline their preferences for medical care, in case they become unable to make their own decisions.

Moral Principle

A foundational belief that guides behavior and helps distinguish right from wrong.

Q1: Pell Company acquires 80% of Demers Company

Q5: Hanson Co. acquired all of the common

Q20: On January 1, 2010, Pond Co. acquired

Q22: If the communication lifetime of civilizations in

Q24: A measure of the range of frequencies

Q30: The ratio of an organism's brain weight

Q61: An organism with an Encephalization Quotient (EQ)

Q82: Gargiulo Company, a 90% owned subsidiary of

Q100: Davidson, Inc. owns 70 percent of the

Q115: What is the primary objective of the