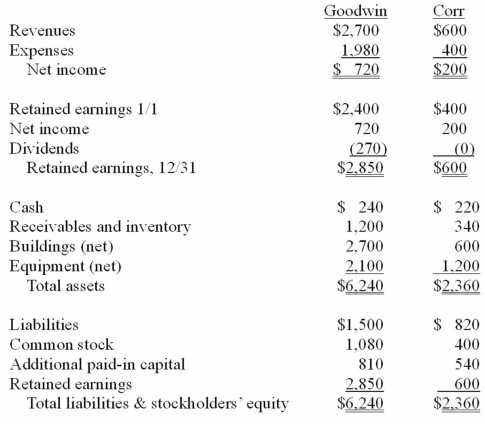

The financial statements for Goodwin, Inc., and Corr Company for the year ended December 31, 20X1, prior to Goodwin's acquisition business combination transaction regarding Corr, follow (in thousands) :

On December 31, 20X1, Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to acquire all of the outstanding shares of that company. Goodwin shares had a fair value of $40 per share.

Goodwin paid $25 to a broker for arranging the transaction. Goodwin paid $35 in stock issuance costs. Corr's equipment was actually worth $1,400 but its buildings were only valued at $560.

In this acquisition business combination, what total amount of common stock and additional paid-in capital is recorded on Goodwin's books?

Definitions:

Occipital Stimulus

A stimulus that targets the occipital lobe of the brain, primarily involved in visual processing.

Proximal Stimulus

The physical energy from a stimulus that directly interacts with sensory receptors.

Agnosias

A class of neurological disorders marked by the inability to recognize objects, people, sounds, shapes, or smells while other sensory functions remain intact.

Aphasias

Language disorders caused by damage to the brain that affect speaking, understanding, reading, and writing.

Q6: How does a gain on an intra-entity

Q11: Pell Company acquires 80% of Demers Company

Q14: What type of civilization would be able

Q22: For each of the following situations (1

Q46: Bullen Inc. acquired 100% of the voting

Q82: Jaynes Inc. acquired all of Aaron Co.'s

Q87: Presented below are the financial balances for

Q90: On January 1, 2011, Deuce Inc. acquired

Q105: When a subsidiary is acquired sometime after

Q115: Which of the following statements is false