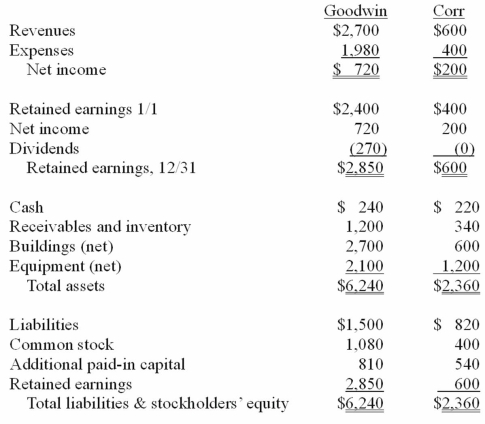

The financial statements for Goodwin, Inc., and Corr Company for the year ended December 31, 20X1, prior to Goodwin's acquisition business combination transaction regarding Corr, follow (in thousands) :

On December 31, 20X1, Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to acquire all of the outstanding shares of that company. Goodwin shares had a fair value of $40 per share.

Goodwin paid $25 to a broker for arranging the transaction. Goodwin paid $35 in stock issuance costs. Corr's equipment was actually worth $1,400 but its buildings were only valued at $560.

Compute the consolidated receivables and inventory for 20X1.

Definitions:

Victoria Terminus

A historic railway station in Mumbai, India, notable for its Victorian Gothic Revival architecture and a symbol of the city's colonial past.

Taj Mahal

A world-renowned ivory-white marble mausoleum in Agra, India, built by Mughal Emperor Shah Jahan in memory of his wife Mumtaz Mahal.

Great Temple of Madurai

A historic Hindu temple located in Madurai, Tamil Nadu, India, dedicated to the goddess Parvati and her consort Shiva, known for its intricate architecture and towering gopurams.

17th Century

The period in history from the year 1601 to 1700, characterized by significant cultural, political, and scientific developments.

Q13: How is the fair value allocation of

Q24: When a star much more massive than

Q59: In order to get large payloads into

Q66: On January 4, 2010, Trycker, Inc. acquired

Q79: Velway Corp. acquired Joker Inc. on January

Q82: Parent Corporation acquired some of its subsidiary's

Q92: Gargiulo Company, a 90% owned subsidiary of

Q99: Thomas Inc. had the following stockholders' equity

Q104: Vontkins Inc. owned all of Quasimota Co.

Q121: All of the following are acceptable methods