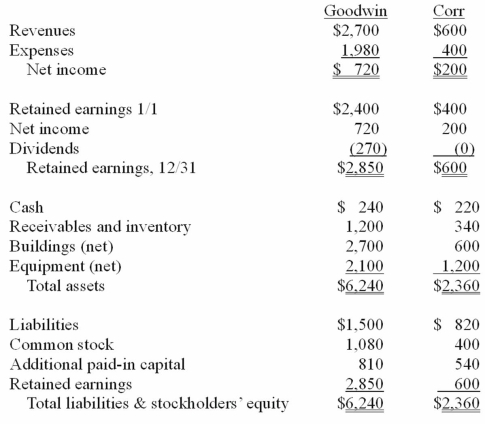

The financial statements for Goodwin, Inc., and Corr Company for the year ended December 31, 20X1, prior to Goodwin's acquisition business combination transaction regarding Corr, follow (in thousands) :

On December 31, 20X1, Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to acquire all of the outstanding shares of that company. Goodwin shares had a fair value of $40 per share.

Goodwin paid $25 to a broker for arranging the transaction. Goodwin paid $35 in stock issuance costs. Corr's equipment was actually worth $1,400 but its buildings were only valued at $560.

Compute the consideration transferred for this acquisition at December 31, 20X1.

Definitions:

Sex Chromosomes

Chromosomes that determine the sex of an organism, with common types being XX for female and XY for male in mammals.

X-linked Allele

A gene located on the X chromosome that can lead to specific traits or diseases depending on its inheritance pattern.

Bar Eye

A genetic mutation in fruit flies that leads to an elongated eye shape, often used in genetics studies.

Heterozygous

Referring to an individual having two different alleles for a particular gene, one inherited from each parent.

Q19: Pursley, Inc. owns 70 percent of Harry,

Q22: What is the difference in consolidated results

Q57: How is the "Fermi Paradox" normally stated?<br>A)

Q59: Gargiulo Company, a 90% owned subsidiary of

Q78: Which of the following statements is false

Q82: On January 1, 20X1, the Moody Company

Q88: A variable interest entity can take all

Q102: Pennant Corp. owns 70% of the common

Q104: Jaynes Inc. acquired all of Aaron Co.'s

Q110: Dodge, Incorporated acquires 15% of Gates Corporation