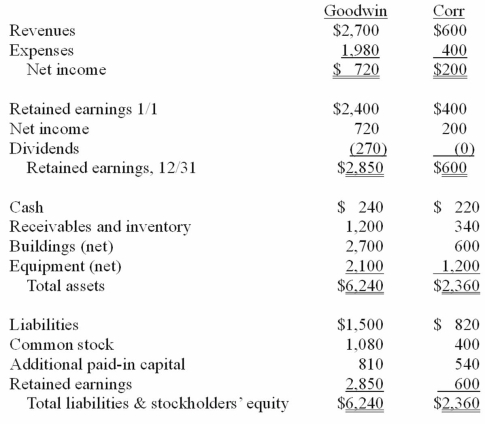

The financial statements for Goodwin, Inc., and Corr Company for the year ended December 31, 20X1, prior to Goodwin's acquisition business combination transaction regarding Corr, follow (in thousands) :

On December 31, 20X1, Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to acquire all of the outstanding shares of that company. Goodwin shares had a fair value of $40 per share.

Goodwin paid $25 to a broker for arranging the transaction. Goodwin paid $35 in stock issuance costs. Corr's equipment was actually worth $1,400 but its buildings were only valued at $560.

Compute the goodwill arising from this acquisition at December 31, 20X1.

Definitions:

Glial Cells

are non-neuronal cells in the central and peripheral nervous systems that support and protect neurons.

Memory Storage

The process by which information is encoded, stored, and retrieved in the brain, making it available for later use.

Retrograde Amnesia

A loss of memory-access to events that occurred or information that was learned before an injury or the onset of a disease.

Right Temporal Lobe

A region of the brain involved in processing auditory information and is also associated with the comprehension of language and the formation of memories.

Q10: Push-down accounting is concerned with the<br>A) impact

Q15: McGuire Company acquired 90 percent of Hogan

Q25: Webb Company owns 90% of Jones Company.

Q28: Hambly Corp. owned 80% of the voting

Q31: Over time the Sun's habitable zone has<br>A)

Q48: Following are selected accounts for Green Corporation

Q66: Which of the following statements is true?<br>A)

Q83: On January 1, 2010, Cale Corp. paid

Q85: Which of the following stars is the

Q107: On January 1, 2009, Nichols Company acquired