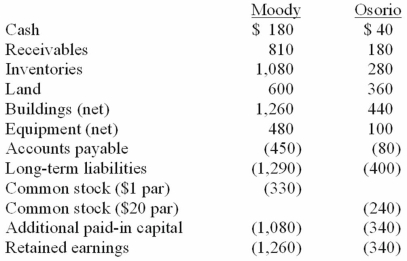

On January 1, 20X1, the Moody Company entered into a transaction for 100% of the outstanding common stock of Osorio Company. To acquire these shares, Moody issued $400 in long-term liabilities and 40 shares of common stock having a par value of $1 per share but a fair value of $10 per share. Moody paid $20 to lawyers, accountants, and brokers for assistance in bringing about this acquisition. Another $15 was paid in connection with stock issuance costs. Prior to these transactions, the balance sheets for the two companies were as follows:

Note: Parentheses indicate a credit balance.

In Moody's appraisal of Osorio, three assets were deemed to be undervalued on the subsidiary's books: Inventory by $10, Land by $40, and Buildings by $60.

What amount was recorded as goodwill arising from this acquisition?

Definitions:

Prepaid Insurance

An asset account representing insurance payments made in advance of the coverage period, recognized as an expense over time.

Insurance Payable

A liability account that represents amounts owed for insurance premiums that are due but not yet paid.

Proprietorship

A business owned by one individual.

Drawing

Drawing refers to the withdrawal of cash or other assets from a company by the owner(s) for personal use, decreasing the owner's equity in the business.

Q4: Most UFO reports consist of<br>A) photographs<br>B) eyewitness

Q10: The first modern SETI search by Frank

Q34: On January 1, 2010, Dawson, Incorporated, paid

Q37: Which of the following statements is true

Q57: Goehring, Inc. owns 70 percent of Harry,

Q89: Pell Company acquires 80% of Demers Company

Q90: On 4/1/09, Sey Mold Corporation acquired 100%

Q93: Pell Company acquires 80% of Demers Company

Q111: The financial statements for Goodwin, Inc., and

Q114: On January 4, 2011, Bailey Corp. purchased