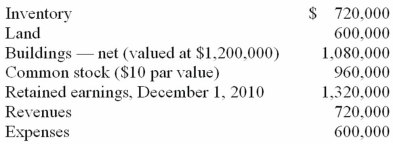

Salem Co. had the following account balances as of December 1, 2010:

Bellington Inc. transferred $1.7 million in cash and 12,000 shares of its newly issued $30 par value common stock (valued at $90 per share) to acquire all of Salem's outstanding common stock.

Determine the balance for Goodwill that would be included in a December 1, 2010, consolidation.

Definitions:

Adjusting Journal Entry

A record created at the conclusion of a financial period to distribute revenues and expenses to their relevant period.

Accrued Interest

The amount of interest that has accumulated on a loan or investment but has not yet been paid or received.

Advisory Services

Professional services that provide expert advice to businesses or individuals in areas such as finance, management, strategy, or operations.

Office Supplies

Items such as pens, paper, staplers, and scissors, which are used regularly in an office environment for various tasks.

Q8: King Corp. owns 85% of James Co.

Q28: How does a parent company account for

Q36: Following are selected accounts for Green Corporation

Q45: On January 4, 2011, Mason Co. purchased

Q48: The term "global warming" refers to an

Q55: On January 1, 2010, Mehan, Incorporated purchased

Q83: On January 1, 2010, Cale Corp. paid

Q84: Perry Company acquires 100% of the stock

Q104: Which of the following results in a

Q107: During 2011, Edwards Co. sold inventory to