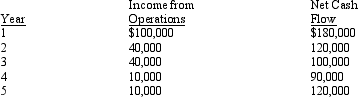

The management of Nebraska Corporation is considering the purchase of a new machine costing $490,000. The company's desired rate of return is 10%. The present value factors for $1 at compound interest of 10% for 1 through 5 years are 0.909, 0.826, 0.751, 0.683, and 0.621, respectively. In addition to the foregoing information, use the following data in determining the acceptability in this situation:  The average rate of return for this investment is:

The average rate of return for this investment is:

Definitions:

Gross Profit

The financial performance metric that subtracts the cost of goods sold from total sales revenue.

Net Sales

The amount of revenue generated by a company after deducting returns, allowances for damaged or missing goods, and any discounts allowed.

Cost of Goods Sold

The specific expenses directly tied to the manufacturing of products sold by a business, such as costs for materials and labor.

Percentage

A fraction or ratio expressed as a part of one hundred, used to describe proportions or compare values.

Q77: Panamint Systems Corporation is estimating activity costs

Q84: Miramar Industries manufactures two products, A and

Q97: Ruby Company produces a chair that requires

Q102: There is no difference in the Investing

Q106: In an investment center, the manager has

Q112: Mallard Corporation uses the product cost concept

Q126: The comparative balance sheet of Posner Company,

Q129: A project has estimated annual cash flows

Q135: Robin Company purchased and used 500 pounds

Q181: Avey Corporation had $275,000 in invested assets,