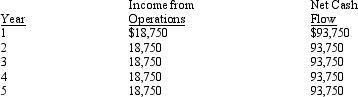

The management of Wyoming Corporation is considering the purchase of a new machine costing $375,000. The company's desired rate of return is 6%. The present value factor for an annuity of $1 at interest of 6% for 5 years is 4.212. In addition to the foregoing information, use the following data in determining the acceptability in this situation:  The average rate of return for this investment is:

The average rate of return for this investment is:

Definitions:

Gene Pair Segregation

The process during cell division in which paired genes on chromosomes are separated into different cells, ensuring genetic diversity.

Genetic Inheritance

The process by which genetic information is passed on from parents to their offspring, determining various physical and sometimes behavioral traits.

Gamete Formation

The process by which male and female sex cells (sperm and ova, respectively) are produced through meiosis.

Plantar Stimulation

Refers to the application of pressure or sensation to the bottom of the feet, often used in reflexology and sensory integration therapies.

Q11: Flyer Company sells a product in a

Q17: Everest Co. uses a plantwide factory overhead

Q30: Tipper Co. is considering a 10-year project

Q57: Since the costs of producing an intermediate

Q59: In a just-in-time (JIT) environment, process problems

Q61: A business received an offer from an

Q72: Jay Company uses the total cost concept

Q87: A company is planning to purchase a

Q145: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2143/.jpg" alt=" Calculate the variable

Q158: Below is a table for the present