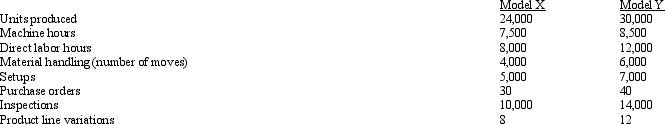

Figure 4-21 Jones Manufacturing uses an activity-based costing system.The company produces Model X and Model Y.Information relating to the two products is as follows: The following overhead costs are reported for the following activities of the production process:

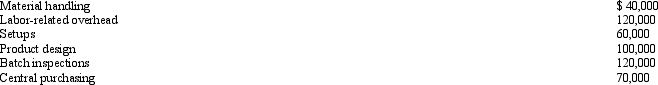

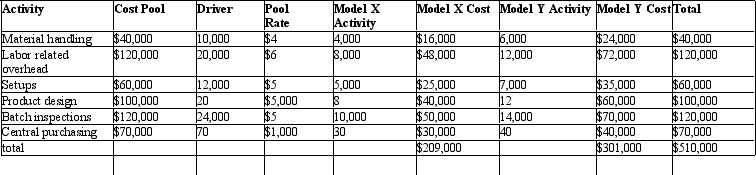

The following overhead costs are reported for the following activities of the production process: Jones manufacturing has used activity based costing to assign costs to Models X and Y as given in the table below:

Jones manufacturing has used activity based costing to assign costs to Models X and Y as given in the table below: Jones Manufacturing wants to implement an approximately relevant ABC system by using the two most expensive activities for cost assignment.

Jones Manufacturing wants to implement an approximately relevant ABC system by using the two most expensive activities for cost assignment.

-

Refer to Figure 4-21.Under this new approach using consumption ratios for labor related and machine hours, what allocation rate would be used to assign labor related costs? (round to 5 decimal places)

Definitions:

Weighted Average Method

A method for calculating the cost of goods sold and the ending inventory value, which utilizes the average cost of all available sale items.

Joint Costs

Costs incurred when producing multiple products simultaneously, which cannot be easily attributed to a single product.

Weight Factor

A factor assigned to each product in a joint manufacturing process representing its importance in comparison to the other products.

Support Department

A division within a company that provides essential services or backup to the production or operations departments, not directly producing goods or services.

Q29: <br>Refer to Figure 6-2.What is the cost

Q44: <br>Refer to Figure 7-7.What is the amount

Q49: Refer to Figure 4-6.What is the overhead

Q70: More accurate product costing information is produced

Q81: <br>Refer to Figure 4-19.What is (are) the

Q88: <br>Refer to Figure 6-1.The journal entry to

Q101: Kryzski Company has a predetermined overhead rate

Q112: Machine hours and electricity costs for Wells

Q123: Which of the following is NOT a

Q124: <br>Refer to Figure 6-6.What cost is assigned