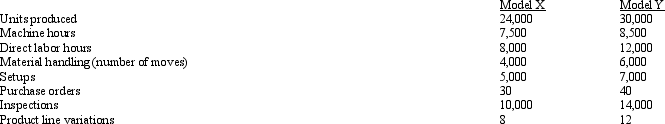

Figure 4-21 Jones Manufacturing uses an activity-based costing system.The company produces Model X and Model Y.Information relating to the two products is as follows: The following overhead costs are reported for the following activities of the production process:

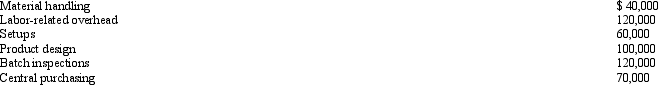

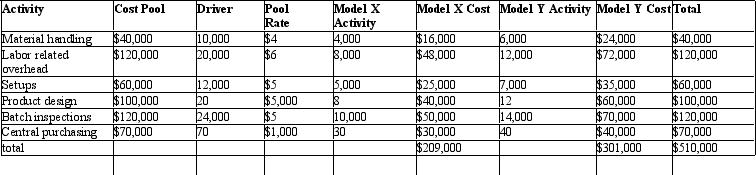

The following overhead costs are reported for the following activities of the production process: Jones manufacturing has used activity based costing to assign costs to Models X and Y as given in the table below:

Jones manufacturing has used activity based costing to assign costs to Models X and Y as given in the table below: Jones Manufacturing wants to implement an approximately relevant ABC system by using the two most expensive activities for cost assignment.

Jones Manufacturing wants to implement an approximately relevant ABC system by using the two most expensive activities for cost assignment.

-

Refer to Figure 4-21.Under this new approach using consumption ratios for labor related and machine hours, the overhead cost assigned to Model X would be? (round to 5 decimal places)

Definitions:

Vulnerable

The state of being open to harm, damage, or illness, either physically or emotionally.

Illness

A condition of poor health perceived or felt by an individual, often characterized by the presence of disease or impairment.

General Adaptation Syndrome

A three-phase process (alarm, resistance, exhaustion) that describes the body's short-term and long-term reactions to stress.

Severe Cold

An intense or acute condition of the common cold, characterized by symptoms such as fever, cough, congestion, and body aches.

Q17: A pure service organization has<br>A) no raw

Q34: Which of the following would NOT be

Q44: Why are firms reluctant to use actual

Q49: Which of the following is NOT an

Q97: Order-getting costs would NOT include<br>A) marketing costs.<br>B)

Q108: The following computer printout estimated overhead costs

Q114: A supervisor's salary of $2,000 per month

Q142: Joint costs are allocated because of<br>A) financial

Q146: Which of the following is an example

Q148: The income statement prepared for external reporting