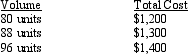

Assume the following information:  What is the variable cost per unit?

What is the variable cost per unit?

Definitions:

Deductions

Amounts subtracted from gross income to reduce taxable income, including certain expenses, contributions, and allowances.

Sales Tax

A tax imposed by a government on the sale of goods and services, usually calculated as a percentage of the sales price.

Excise Tax

A tax imposed on specific goods, services, or transactions, often included in the price of the product, like fuel, tobacco, and alcohol.

Per-Unit Basis

A method of expressing or measuring something in terms of a single unit or a fixed amount per unit.

Q14: Explain why actual costing systems are rarely

Q20: Which of the following costs is usually

Q26: Selected data concerning the past year's operations

Q56: Which of the following costs is NOT

Q58: What system would a manufacturer of unique

Q70: <br>Refer to Figure 6-14.The cost of goods

Q76: If activity-based costing is used, insurance on

Q99: _ is a unit-costing method that excludes

Q111: Beef Products produces two products, hamburger and

Q154: _ are expensed in the period in