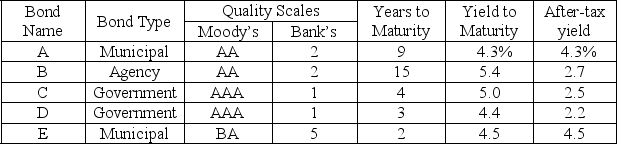

A portfolio manager in charge of a bank portfolio has $10 million to invest. The securities available for purchase, as well as their respective quality ratings, maturities, and yields, are shown in the table below:

The bank places the following policy limitations on the portfolio manager's actions:

1. Government and agency bonds must total at least $4 million.

2. The average quality of the portfolio cannot exceed 1.4 on the bank's quality scale. (Note that a low number on this scale means a high-quality bond.)

3. The average years to maturity of the portfolio must not exceed 5 years.

Assuming that the objective of the portfolio manager is to maximize after-tax earnings and that the tax rate is 50%, formulate a linear program that can be used to determine how much money to invest in each type of bond.

Definitions:

Situational Attributions

The process of attributing a person's behavior to external or environmental factors instead of to internal personality traits.

Fundamental Attribution Error

A common bias in social psychology where individuals attribute others' actions to their personality or disposition rather than situational factors affecting those actions.

Foot-In-The-Door Phenomenon

The tactic of influencing a person to agree to a large request by first getting them to agree to a modest request.

Enforce Recycling

The act of ensuring compliance with recycling laws and policies to reduce waste and environmental impact.

Q1: What Excel feature works backwards to find

Q25: Consider the following partial ATP MPS record.

Q32: Which of the following specifically relates to

Q37: Logo, Inc. can transport its own goods

Q38: When formulating optimization problems, which of the

Q64: What are the two elements that define

Q103: Costs that are proportional to the amount

Q105: Teflon is an example of what?<br>A) process

Q126: After running a Linear Program in Excel

Q131: Crossdocking allows the retailer to replace _